The First Home Super Saver (FHSS) scheme allows individuals to save money for their first home inside their super fund. It is an initiative by the federal government and operates separately from any state-based first home buyer incentives.

Under the FHSS scheme, first home buyers can contribute up to $50,000 to their super funds and access these funds when purchasing their first home. By doing so, individuals can benefit from favourable tax outcomes, ultimately helping them accumulate a substantial deposit for their future home.

Effective from 1 July 2017, you can make voluntary concessional (before-tax) and voluntary non-concessional (after-tax) contributions into your super fund to save for your first home.

You can apply to have a maximum of $15,000 of your voluntary contributions from any given financial year included in your eligible contributions to be released under the FHSS scheme, with a total cap of $50,000 across all years. Additionally, you will receive an amount of earnings related to those contributions.

Eligibility Criteria

To qualify for the FHSS scheme, you must be a first home buyer and meet both of the following conditions:

- You will occupy the property you purchase or intend to do so as soon as practicable.

- You intend to reside in the property for at least six months within the first 12 months of ownership, once it is practical to move in.

Eligibility is assessed on an individual basis, meaning that couples, siblings, or friends can each access their own eligible FHSS contributions to purchase the same property. If any of the individuals have previously owned a home, it will not prevent others who are eligible from applying.

Tax Benefits – Based on contributions being concessional

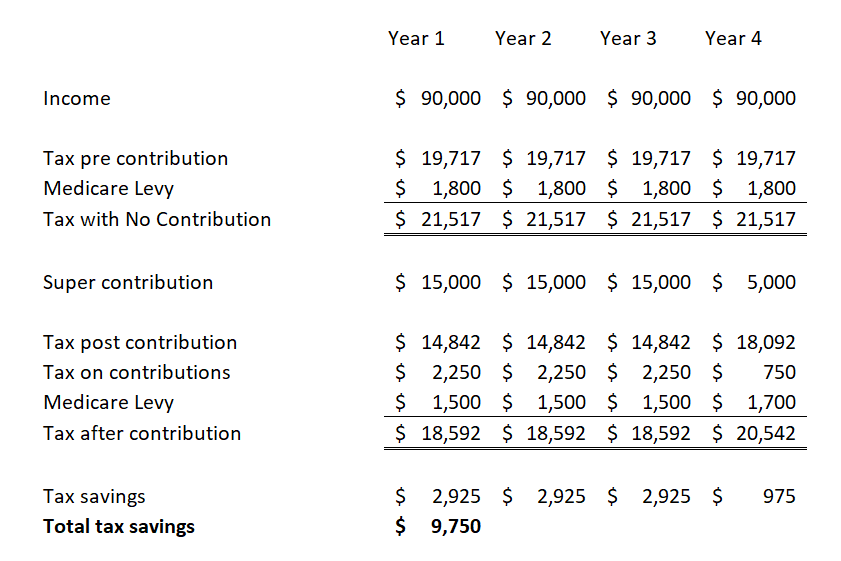

The FHSS scheme offers significant tax advantages. For example, an individual earning $90,000 per annum can achieve up to $9,750 in tax savings by utilizing the full $50,000 threshold over four years. If purchasing a property with a partner, both individuals may access the same savings, potentially resulting in combined tax savings of approximately $19,500. These calculations do not account for any applicable tax offsets and exclude any tax savings on income earned within the superannuation fund.

Please refer to the graph below for a detailed overview of the tax benefits associated with the FHSS scheme

Tax Implications on Withdrawal

When withdrawing funds under the FHSS scheme, the full amount released will be added to your assessable income for that financial year. A 30% tax offset will apply, and your marginal tax rate will be used to determine the final tax payable.

Conclusion

The FHSS scheme is a valuable option for individuals looking to purchase their first home. If you are considering utilizing this scheme and would like further information, please feel free to contact me.

Luke Spies

Director

Agyle Co Pty Ltd

This content is intended for informational purposes, you should not construe any such information or other material as legal, tax, investment, financial or other advice.